Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools:

Park Avenue Securities LLC lifted its stake in shares of Littelfuse, Inc. (NASDAQ:LFUS - Get Rating) by 22.6% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 3,137 shares of the technology company's stock after acquiring an additional 578 shares during the quarter. Park Avenue Securities LLC's holdings in Littelfuse were worth $623,000 at the end of the most recent reporting period. metal case

Several other hedge funds and other institutional investors have also added to or reduced their stakes in the business. Bourne Lent Asset Management Inc. boosted its stake in Littelfuse by 50.0% in the 3rd quarter. Bourne Lent Asset Management Inc. now owns 1,200 shares of the technology company's stock worth $238,000 after purchasing an additional 400 shares during the period. State of New Jersey Common Pension Fund D boosted its stake in Littelfuse by 4.9% in the 3rd quarter. State of New Jersey Common Pension Fund D now owns 14,520 shares of the technology company's stock worth $2,885,000 after purchasing an additional 678 shares during the period. GHP Investment Advisors Inc. boosted its stake in Littelfuse by 8.7% in the 3rd quarter. GHP Investment Advisors Inc. now owns 29,223 shares of the technology company's stock worth $5,806,000 after purchasing an additional 2,340 shares during the period. Comerica Bank boosted its stake in Littelfuse by 165.3% in the 3rd quarter. Comerica Bank now owns 32,205 shares of the technology company's stock worth $6,790,000 after purchasing an additional 20,065 shares during the period. Finally, Van ECK Associates Corp boosted its stake in Littelfuse by 9.9% in the 3rd quarter. Van ECK Associates Corp now owns 701 shares of the technology company's stock worth $139,000 after purchasing an additional 63 shares during the period. 94.69% of the stock is currently owned by institutional investors. Insider Transactions at Littelfuse

In related news, CAO Jeffrey G. Gorski sold 300 shares of Littelfuse stock in a transaction that occurred on Friday, November 11th. The stock was sold at an average price of $236.14, for a total transaction of $70,842.00. Following the completion of the transaction, the chief accounting officer now directly owns 2,563 shares in the company, valued at $605,226.82. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In other Littelfuse news, SVP Matthew Cole sold 900 shares of the business's stock in a transaction on Wednesday, November 9th. The stock was sold at an average price of $219.28, for a total transaction of $197,352.00. Following the transaction, the senior vice president now owns 5,174 shares of the company's stock, valued at $1,134,554.72. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, CAO Jeffrey G. Gorski sold 300 shares of the business's stock in a transaction on Friday, November 11th. The stock was sold at an average price of $236.14, for a total value of $70,842.00. Following the transaction, the chief accounting officer now directly owns 2,563 shares in the company, valued at approximately $605,226.82. The disclosure for this sale can be found here. Company insiders own 2.40% of the company's stock. Littelfuse Trading Down 2.9 %

Littelfuse stock opened at $238.26 on Friday. The stock has a 50-day moving average of $234.50 and a two-hundred day moving average of $231.63. The company has a debt-to-equity ratio of 0.47, a quick ratio of 1.99 and a current ratio of 3.19. Littelfuse, Inc. has a one year low of $192.19 and a one year high of $294.59. The stock has a market cap of $5.90 billion, a PE ratio of 17.94, a price-to-earnings-growth ratio of 1.43 and a beta of 1.25.

Littelfuse (NASDAQ:LFUS - Get Rating) last announced its quarterly earnings data on Tuesday, November 1st. The technology company reported $4.28 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.81 by $0.47. Littelfuse had a return on equity of 20.76% and a net margin of 13.53%. The firm had revenue of $658.88 million during the quarter, compared to analysts' expectations of $638.13 million. On average, research analysts anticipate that Littelfuse, Inc. will post 16.77 EPS for the current fiscal year. Littelfuse Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, December 8th. Stockholders of record on Thursday, November 24th were paid a $0.60 dividend. This represents a $2.40 annualized dividend and a dividend yield of 1.01%. The ex-dividend date of this dividend was Tuesday, November 22nd. Littelfuse's payout ratio is 18.07%. Wall Street Analyst Weigh In

Several analysts have recently issued reports on the company. Jefferies Financial Group upped their price objective on Littelfuse from $254.00 to $295.00 in a report on Tuesday, November 22nd. Stifel Nicolaus decreased their price objective on Littelfuse from $270.00 to $216.00 and set a "hold" rating on the stock in a report on Monday, October 10th. Cowen cut Littelfuse from an "outperform" rating to a "market perform" rating and decreased their price objective for the stock from $295.00 to $225.00 in a report on Thursday, November 3rd. Cowen lowered Littelfuse from an "outperform" rating to a "market perform" rating and reduced their target price for the stock from $295.00 to $225.00 in a research note on Thursday, November 3rd. Finally, StockNews.com initiated coverage on Littelfuse in a research report on Wednesday, October 12th. They set a "hold" rating on the stock. Six analysts have rated the stock with a hold rating, Based on data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $241.20.About Littelfuse (Get Rating)

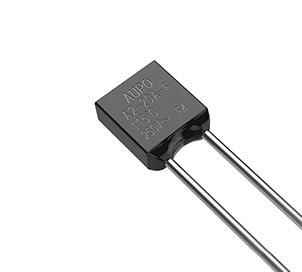

Littelfuse, Inc manufactures and sells circuit protection, power control, and sensing products in the Asia-Pacific, the Americas, and Europe. The company's Electronics segment offers fuses and fuse accessories, positive temperature coefficient resettable fuses, polymer electrostatic discharge suppressors, varistors, reed switch based magnetic sensing products, and gas discharge tubes; and discrete transient voltage suppressor (TVS) diodes, TVS diode arrays, protection and switching thyristors, metal-oxide-semiconductor field-effect transistors and diodes, and insulated gate bipolar transistors.Featured ArticlesGet a free copy of the StockNews.com research report on Littelfuse (LFUS)Exxon Mobil Stock: Within Striking Distance Of Buy PointHigh-Dividend-Yielding BHP Sees China Driving '23 GrowthIs Airbnb Setting Up To Rally 38%, As Analysts Are Forecasting?Does a Price Cut for Tesla Vehicles Mean the Same for TSLA Stock?Microsoft Layoffs Signal Layoffs for Other Tech Companies?

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Littelfuse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Littelfuse wasn't on the list.

While Littelfuse currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools:

View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio.

Get daily stock ideas from top-performing Wall Street analysts. Get short term trading ideas from the MarketBeat Idea Engine. View which stocks are hot on social media with MarketBeat's trending stocks report.

Identify stocks that meet your criteria using seven unique stock screeners. See what's happening in the market right now with MarketBeat's real-time news feed. Export data to Excel for your own analysis.

326 E 8th St #105, Sioux Falls, SD 57103 contact@marketbeat.com (844) 978-6257

© American Consumer News, LLC dba MarketBeat® 2010-2023. All rights reserved.

spring bounce off © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer.